Investor Insight

Syntheia’s innovative conversational AI solution is transforming the face of customer engagement for the B2B market. Backed by a stable financial foundation, Syntheia is well-placed to execute its growth strategy, offering investors a compelling opportunity.

Overview

Syntheia (CSE:SYAI) has rapidly emerged as an innovative player in the expanding conversational AI platform-as-a-service market.

In an industry poised to transform customer engagement, Syntheia addresses the complex needs of modern communication through cutting-edge AI solutions. Designed to emulate human-like conversations over phone and digital channels, Syntheia’s platform targets both large enterprises and small-to-medium businesses, which often struggle with customer support inefficiencies and high employee turnover in customer-facing roles. Syntheia’s focus on language processing, tonality, sentiment analysis, and conversational behavior makes its offerings distinctive, providing customers an experience that moves closer to natural human interaction than traditional chatbot solutions.

At the core of Syntheia’s strategy is an innovative approach to AI-driven customer service solutions, a sector experiencing explosive growth. The global conversational AI market, valued at $9.9 billion in 2023, is anticipated to reach a staggering $32.62 billion by 2030. With a projected compound annual growth rate of 21.5 percent, the demand for AI solutions that can handle customer inquiries seamlessly is clear. Factors fueling this market growth include the rising demand for customer-centric interactions, the need for operational efficiency, and cost reductions that companies can realize by automating and enhancing their customer support processes. Syntheia is well-positioned within this trend, providing businesses with tools that reduce onboarding costs, language barriers and other operational challenges while enhancing engagement.

Syntheia is listed on the Canadian Securities Exchange under the ticker symbol SYAI, and its stock is closely held, with a tight float that allows for controlled expansion of shares. Financially, the company is in a solid position with $2 million in cash and no debt, and maintains a well-structured capitalization profile that includes options and warrants. This stable financial foundation provides Syntheia with the means to execute its growth strategy while maintaining flexibility to adapt to market shifts.

Company Highlights

Syntheia is a conversational AI solution delivering AI-driven, human-like customer service for enterprises and SMBs.

The AssistantNLP Platform offers 24/7/365 multilingual support, accessible globally.

Syntheia operates on a freemium revenue model, with scalable plans catering to varied business sizes and needs.

The conversational AI market is expected to reach $32.62 billion by 2030, with Syntheia well-positioned to capitalize on this growth.

Syntheia’s algorithms have achieved an 84 percent success rate in data collection and 98 percent in outreach programs, highlighting exceptional efficiency.

Financially stable, Syntheia has $2 million in cash, no debt and trades on the Canadian Securities Exchange.

Key Technology

Syntheia is a front-runner in conversational AI, employing natural language processing (NLP) algorithms that are continually refined for accuracy and contextual understanding. The platform’s advanced NLP technology, bolstered by proprietary algorithms, enables it to understand and respond to various conversational cues, including tone, sentiment, semantics, and even idiomatic expressions. These sophisticated capabilities make interactions feel more fluid, accurate and responsive, which is particularly advantageous in sectors like healthcare, finance and customer service, where nuanced communication is essential. In fact, Syntheia’s algorithms exhibit impressive efficacy rates, achieving an 84 percent success rate in data collection and a 98 percent success rate in outreach initiatives, demonstrating the system’s effectiveness in real-world applications.

One of the most compelling aspects of Syntheia’s solution is its proprietary AssistantNLP platform, which offers 24/7/365 conversational AI service. The AssistantNLP platform is designed to handle high volumes of customer queries in multiple languages and across industries, ensuring a scalable, reliable and flexible solution for diverse customer needs. Syntheia’s platform is also highly accessible, structured around a freemium revenue model that allows businesses to try the service at no cost and then upgrade based on usage and additional features. The freemium model’s flexibility is essential in broadening Syntheia’s customer base by reducing the initial financial commitment for prospective clients and encouraging growth from smaller firms to larger enterprise accounts.

Management Team

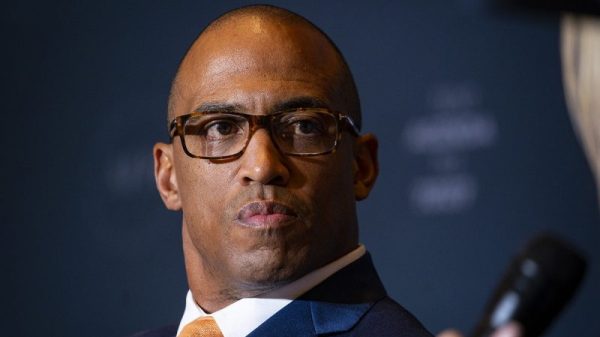

Tony Di Benedetto – Chairman, Chief Executive Officer

Tony Di Benedetto has nearly 20 years of IT entrepreneurship, mergers and acquisitions, and capital markets experience. As a seasoned technology business leader, he has successfully built and brought multiple tech businesses to market.

Richard Buzbuzian – President

Richard Buzbuzian is a capital markets executive with over 25 years of investment experience in Canada and Europe, and operates a family office with an investment portfolio of public and pre-IPO companies. Buzbuzian holds a degree from the University of Toronto.

Paul Di Benedetto – Chief Technology Officer

Paul Di Benedetto is a technology visionary with expertise in diverse innovative technologies, including blockchain and AI. He is responsible for overseeing the ongoing development of patent-approved technology at work from Syntheia.

Veronique Laberge – Chief Financial Officer

Veronique Laberge is a chartered professional accountant and holds the title of auditor. With more than 17 years of experience in professional practice, she specializes in certification mandates and general accounting, and acts as a consultant for public and private companies.

Emilio Iantorno – VP of Product & Experience Strategy

Emilio Iantorno, a 20-year design veteran, specializes in crafting engaging product experiences for diverse audiences and industries. Emilio leads the Syntheia design process, effectively harnessing the best technology to tackle business challenges.