Conference Call and Webcast on November 6, 2023

Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR) (‘Energy Fuels’ or the ‘Company’) today reported its financial results for the quarter ended September 30, 2023. The Company’s Quarterly Report on Form 10-Q has been filed with the U.S. Securities and Exchange Commission (‘ SEC ‘) and may be viewed on the Electronic Document Gathering and Retrieval System (‘ EDGAR ‘) at www.sec.govedgar.shtml on the System for Electronic Document Analysis and Retrieval (‘ SEDAR ‘) at www.sedar.com and on the Company’s website at www.energyfuels.com . Unless noted otherwise, all dollar amounts are in U.S. dollars.

Financial Highlights:

As of September 30, 2023 , the Company had a robust balance sheet with $162.50 million of working capital (versus $116.97 million as of December 31, 2022 ), including $54.54 million of cash and cash equivalents, $70.62 million of marketable securities, $27.66 million of inventory, and no debt. At current commodity prices, the Company’s product inventory has a value of approximately $49.09 million ; During the three months ended September 30, 2023 , the Company earned net income of $10.47 million , or $0.07 per share, which included: (i) the sale of 180,000 pounds of uranium (‘ U 3 O 8 ‘) to a major U.S. nuclear utility for $10.47 million , resulting in a gross profit of $5.21 million (50%); (ii) sale of 26 metric tons (‘ MT ‘) of RE Carbonate for $0.29 million ; (iii) a non-cash mark-to-market gain on investments accounted for at fair value of $8.89 million ; (iv) a non-cash unrealized gain on the secured convertible note received by the Company as partial consideration for the sale of the Company’s Alta Mesa Project in Q1 2023 of $7.22 million ; and (v) interest income of $0.44 million ; partially offset by (i) expenses associated with preparing four (4) of our uranium mines for production; and (ii) expenses associated with developing commercial rare earth element (‘ REE ‘) separation capabilities. As of September 30, 2023 , the Company held 586,000 pounds of U 3 O 8 , 906,000 pounds of finished vanadium pentoxide (‘ V 2 O 5 ‘), and 11 MT of finished high-purity, partially separated mixed REE carbonate (‘ RE Carbonate ‘) in inventory. The Company holds an additional 409,000 lbs. of U 3 O 8 as raw materials and work-in-progress inventory, along with an estimated 1 – 3 million pounds of solubilized V 2 O 5 in tailings solutions that could be recovered in the future.

Uranium Highlights:

During Q3-2023, the Company completed the sale of 180,000 pounds of U 3 O 8 to a major U.S. nuclear utility for $10.47 million , or $58.18 per pound, which resulted in a gross profit of $5.21 million or $28.93 per pound of U 3 O 8 . This sale resulted in a gross margin of 50% per pound of uranium. This was the Company’s second delivery under its new portfolio of long-term uranium sales agreements. In 2023, the Company has sold a total of 560,000 pounds of uranium for a weighted average realized price of $59.42 per pound resulting in a gross margin of 54%. The Company has no additional contract deliveries scheduled for the remainder of 2023. Over the past several months, the Company has made significant progress in preparing four (4) of our conventional uranium and uranium/vanadium mines to be ready to resume production, including significant workforce expansion, and performing needed rehabilitation and development of surface and underground infrastructure. We expect to begin production at one or more of these mines by early 2024, with the mined material being stockpiled at the White Mesa Mill (the ‘ Mill ‘) until such time that sufficient material is accumulated to justify a mill campaign, which is expected to occur in late-2024 or early-2025. As of October 27, 2023 , the spot price of U 3 O 8 was $73.50 per pound and the long-term price of U 3 O 8 , which is the price most relevant for long-term uranium sales contracts, was $62.00 per pound, according to data from TradeTech.

Rare Earth Element Highlights:

In early 2023, the Company began modifying and enhancing its existing solvent extraction (‘ SX ‘) circuits at the Mill to be able to produce separated REE oxides (‘ Phase 1 ‘). The Company has begun this development work in its existing SX building, and most of the major components for this project are currently being delivered to the Mill on time and on-budget. ‘Phase 1’ capital costs are expected to total approximately $25 million . 1, 000 MT of NdPr in permanent magnets could power up to 1 million electric vehicles (‘ EVs ‘) per year. The Company is engineering further enhancements at the Mill to increase NdPr production capacity to up to approximately 3, 000 MT per year by 2026/2027 (‘ Phase 2 ‘), and to produce separated dysprosium (‘ Dy ‘), terbium (‘ Tb ‘) and potentially other advanced REE materials in the future from monazite and potentially other REE process streams by 2027/2028 ( ‘Phase 3’ ). During the first half of 2023, the Company completed 2,266 meters of sonic drilling at its Bahia Project in Brazil to confirm and further delineate the rare earth, titanium, and zirconium mineralization. The Company expects to commence further sonic drilling later in Q4-2023. Drilling results from the first round of drilling are expected in early 2024 at which time the Company plans to commence preparation of an SK-1300 and NI 43-101 compliant mineral resource estimate. The Company continues active discussions with several additional suppliers of natural monazite around the world to significantly increase the supply of feed for our growing REE initiative. As of October 27, 2023 , the spot price of NdPr oxide was approximately $69.64 per kg, according to data from Asian Metal.

Vanadium Highlights:

During the three months ended September 30, 2023 , the Company sold no vanadium. The Company produces high-purity V 2 O 5 from time-to-time when the Mill schedule allows and carries that material in inventory for sale into market strength, including during Q1-2023 when the Company sold approximately 79,344 pounds of V 2 O 5 for an average realized sales price of $10.98 per pound. The Company currently holds approximately 906,000 pounds of V 2 O 5 in inventory. As of October 27, 2023 , the spot price of V 2 O 5 was $6.73 per pound, according to data from Fastmarkets.

Medical Isotope Highlights:

The Company continued advancing its program to evaluate the potential to recover radioisotopes from its process streams for use in emerging targeted alpha therapy (‘ TAT ‘) cancer therapeutics.

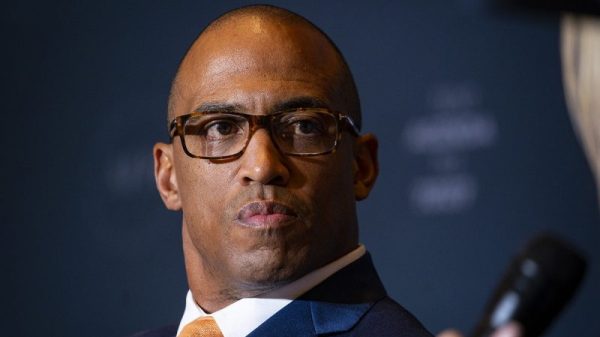

Mark S. Chalmers , Energy Fuels’ President and CEO, stated:

‘Energy Fuels continued to make excellent progress during Q3-2023 in creating a U.S. critical mineral hub for the production of uranium, rare earth elements, vanadium, and potentially radioisotopes for the development of medical isotopes. Energy Fuels has been the largest producer of uranium in the U.S. for the past several years, and we are commercially producing the most advanced rare earth materials in the U.S. while moving further down the rare earth supply chain.

‘On uranium, we completed the sale of 180,000 pounds of uranium to one of our utility customers under one of our long-term contracts, realizing total proceeds of $10.47 million , or $58.18 per pound of U 3 O 8 , slightly beating our previous guidance of $54 – $58 per pound. We also continued preparing four (4) of our conventional uranium mines for production, which together, have the ability to produce 1 million to 1.3 million pounds of uranium per year, not including vanadium credits of potentially 2 million pounds per year, at full production rates. We expect to begin production at one or more of these mines by early 2024, with the mined material being stockpiled at the White Mesa Mill until a sufficient quantity is accumulated to justify a mill campaign, which is expected to occur in late-2024 or early-2025, subject to contract requirements and successful operations.

‘There are significant ‘tailwinds’ currently driving uranium markets, including increasing prices and government policies. Uranium spot prices are up over 50% in 2023, which is improving our expected contract sales prices, increasing the value of our significant inventories, and increasing the value of our resources. At the same time, uranium spot markets are very tight, considerable money is flowing into the sector, geopolitical factors and security of supply are paramount, and market prices remain significantly at or below the levels needed to incentivize large-scale new production and below inflation-adjusted highs. These dynamics could cause prices to continue to rise higher, perhaps significantly so.

‘Energy Fuels also remains on schedule to complete ‘Phase 1’ of our rare earth project at the White Mesa Mill in Utah , which involves modifications and enhancements to the Mill’s existing SX building that are expected to have the capacity to produce approximately 800 – 1,000 metric tons of separated NdPr oxide per annum. We are refurbishing the Mill’s existing SX building as part of this process, and we have completed the installation of a new roof and new concrete pads for the SX cells, tanks, pumps, and other equipment. We are also receiving the new SX cells, which are expected to be installed in Q4-2023. Upon successful ramp-up of the modified SX circuit and receipt of sufficient monazite feed, Energy Fuels is expected to be the first U.S. company in many years with the ability to produce commercial quantities of NdPr oxide, which is a key ingredient in powerful permanent rare earth magnets used in electric vehicles, wind generators, and other technologies.

‘Later this year, we continue to expect to begin pilot work on ‘heavy’ rare earth separation, including the production of separated dysprosium (Dy) and terbium (Tb) oxides. At the same time, we continue to move our Bahia Rare Earth Project in Brazil forward toward production and secure additional sources of monazite supply to process at the Mill for rare earth production, while advancing discussions with end-users.

‘Energy Fuels’ business strategy and execution sits at an intersection of rapidly growing commodity markets, critical to the clean energy transition. And, as a U.S. company, we offer customers security of supply and insulation from geopolitical turmoil. We plan to continue to leverage these unique advantages to the benefit of our shareholders as we rapidly advance our plans.’

Conference Call and Webcast at 4:00 pm ET on November 6, 2023:

Energy Fuels will be hosting a conference call and webcast on November 6, 2023 at 4:00 pm ET ( 2:00 pm MT ) to discuss our Q3-2023 financial results, the outlook for the remainder of 2023, and our uranium, rare earths, vanadium, and medical isotopes initiatives.

To instantly join the conference call by phone, please use the following link to easily register your name and phone number. After registering, you will receive a call immediately and be placed into the conference call: RAPIDCONNECT

Alternatively, you may dial in to the conference call by calling 1-888-664-6392, and you will be connected to the call by an Operator.

You may also access viewer-controlled Webcast slides and/or stream the call by following this link: WEBCAST

A replay of the call will be available until November 20, 2023 by calling (888) 390-0541 or (416) 764-8677 and entering the replay code, 368182#

Selected Summary Financial Information:

Three Months Ended

Nine Months Ended

September 30,

September 30,

$000’s, except per share data

2023

2022

2023

2022

Results of Operations:

Uranium concentrates revenues

$ 10,473

$ —

$ 33,278

$ —

Vanadium concentrates revenues

—

1,071

871

8,778

RE Carbonate revenues

288

1,673

2,559

2,122

Total revenues

10,987

2,933

37,463

12,337

Gross profit

5,439

1,404

19,282

4,497

Operating loss

(6,944)

(13,664)

(18,011)

(30,584)

Net income (loss)

10,469

(9,254)

119,849

(42,043)

Basic net income (loss) per common share

0.07

(0.06)

0.76

(0.27)

Diluted net income (loss) per common share

0.07

(0.06)

0.75

(0.27)

As of

As of

$000’s

September 30, 2023

December 31, 2022

Percent Change

Financial Position:

Working capital

$ 162,495

$ 116,966

39 %

Current assets

168,769

135,590

24 %

Property, plant and equipment, net

20,208

12,662

60 %

Mineral properties

117,096

83,539

40 %

Total assets

401,194

273,947

46 %

Current liabilities

6,274

18,624

(66) %

Total liabilities

17,866

29,538

(40) %

ABOUT Energy Fuels

Energy Fuels is a leading US-based critical minerals company. The Company, as the leading producer of uranium in the United States , mines uranium and produces natural uranium concentrates that are sold to major nuclear utilities for the production of carbon-free nuclear energy. Energy Fuels recently began production of advanced rare earth element (‘ REE ‘) materials, including mixed REE carbonate, and plans to produce commercial quantities of separated REE oxides in the future. Energy Fuels also produces vanadium from certain of its projects, as market conditions warrant, and is evaluating the recovery of radionuclides needed for emerging cancer treatments. Its corporate offices are in Lakewood, Colorado , near Denver , and substantially all its assets and employees are in the United States . Energy Fuels holds two of America’s key uranium production centers: the White Mesa Mill in Utah and the Nichols Ranch in-situ recovery (‘ ISR ‘) Project in Wyoming . The White Mesa Mill is the only conventional uranium mill operating in the US today, has a licensed capacity of over 8 million pounds of U 3 O 8 per year, and has the ability to produce vanadium when market conditions warrant, as well as REE products, from various uranium-bearing ores. The Nichols Ranch ISR Project is on standby and has a licensed capacity of 2 million pounds of U 3 O 8 per year. The Company recently acquired the Bahia Project in Brazil , which is believed to have significant quantities of titanium (ilmenite and rutile), zirconium (zircon) and REE (monazite) minerals. In addition to the above production facilities, Energy Fuels also has one of the largest NI 43-101 compliant uranium resource portfolios in the US and several uranium and uranium/vanadium mining projects on standby and in various stages of permitting and development. The primary trading market for Energy Fuels’ common shares is the NYSE American under the trading symbol ‘UUUU,’ and the Company’s common shares are also listed on the Toronto Stock Exchange under the trading symbol ‘EFR.’ Energy Fuels’ website is www.energyfuels.com .

Cautionary Note Regarding Forward-Looking Statements: This news release contains certain ‘Forward Looking Information’ and ‘Forward Looking Statements’ within the meaning of applicable United States and Canadian securities legislation, which may include, but are not limited to, statements with respect to: any expectation that the Company will maintain its position as a leading U.S.-based critical minerals company or as the leading producer of uranium in the U.S.; any expectation with respect to timelines to production; any expectation that the Mill will be successful in producing RE Carbonate on a full-scale commercial basis; any expectation that Energy Fuels will be successful in developing U.S. separation, or other value-added U.S. REE production capabilities at the Mill, or otherwise, including the timing of any such initiatives and the expected production capacity or capital costs associated with any such production capabilities; any expectation that the Company’s planned Phase 1 separation facility will position the Company as one of the world’s leading producers of NdPr outside of China ; any expectation as to the quantity of U 3 O 8 and V 2 O 5 the Company may hold as raw material and work-in-progress inventory or solubilized in tailings solution and the Company’s ability to recover any such inventories in the future; any expectation with respect to the quantities of monazite to be acquired by Energy Fuels, or the quantities of RE Carbonate or REE oxides to be produced by the Mill; any expectation that the Company may sell its separated NdPr oxide to electric vehicle manufacturers or move furthur down the rare earth supply chain; any expectation that the Bahia Project has the potential to feed the Mill with REE and uranium-bearing monazite sand; any expectation that the Company will commence further sonic drilling at its Bahia Project in Q4-2023, announce drilling results in early 2024, or commence preparation of an SK-1300 and NI 43-101 compliant mineral resource estimate during 2024, or otherwise; any expectation that the Company’s evaluation of radioisotope recovery at the Mill will be successful; any expectation that the potential recovery of medical isotopes from any radioisotopes recovered at the Mill will be feasible; any expectation that any radioisotopes that can be recovered at the Mill will be sold on a commercial basis; any expectation as to the quantities to be delivered under existing uranium sales contracts; any expectation that the Company will be successful in completing any additional contracts for the sale of uranium to U.S. utilities on commercially reasonable terms or at all; any expectation that there are significant ‘tailwinds’ driving uranium markets or that any such forces will continue and any expectations that these or other dynamics could cause prices to continue to rise higher; and any expectation that as a U.S. Company, the Company will offer its customers security of supply and insulation from geopolitical turmoil or that the Company can continue to leverage its advantages to the benefit of its shareholders. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as ‘plans,’ ‘expects,’ ‘does not expect,’ ‘is expected,’ ‘is likely,’ ‘budgets,’ ‘scheduled,’ ‘estimates,’ ‘forecasts,’ ‘intends,’ ‘anticipates,’ ‘does not anticipate,’ or ‘believes,’ or variations of such words and phrases, or state that certain actions, events or results ‘may,’ ‘could,’ ‘would,’ ‘might’ or ‘will be taken,’ ‘occur,’ ‘be achieved’ or ‘have the potential to.’ All statements, other than statements of historical fact, herein are considered to be forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements express or implied by the forward-looking statements. Factors that could cause actual results to differ materially from those anticipated in these forward-looking statements include risks associated with: commodity prices and price fluctuations; engineering, construction, processing and mining difficulties, upsets and delays; permitting and licensing requirements and delays; changes to regulatory requirements; legal challenges; the availability of feed sources for the Mill; competition from other producers; public opinion; government and political actions; available supplies of monazite; the ability of the Mill to produce RE Carbonate, REE oxides or other REE products to meet commercial specifications on a commercial scale at acceptable costs or at all; market factors, including future demand for REEs; the ability of the Mill to be able to separate radium or other radioisotopes at reasonable costs or at all; market prices and demand for medical isotopes; and the other factors described under the caption ‘Risk Factors’ in the Company’s most recently filed Annual Report on Form 10-K, which is available for review on EDGAR at www.sec.gov/edgar.shtml , on SEDAR at www.sedar.com , and on the Company’s website at www.energyfuels.com . Forward-looking statements contained herein are made as of the date of this news release, and the Company disclaims, other than as required by law, any obligation to update any forward-looking statements whether as a result of new information, results, future events, circumstances, or if management’s estimates or opinions should change, or otherwise. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements. The Company assumes no obligation to update the information in this communication, except as otherwise required by law.

View original content: https://www.prnewswire.com/news-releases/energy-fuels-announces-q3-2023-results-including-net-income-continued-significant-increase-in-working-capital-profitable-uranium-sales-and-continued-progress-on-development-of-uranium-mines-and-rare-earth-separation-capabiliti-301977616.html

SOURCE Energy Fuels Inc.

View original content: http://www.newswire.ca/en/releases/archive/November2023/03/c0737.html

News Provided by Canada Newswire via QuoteMedia