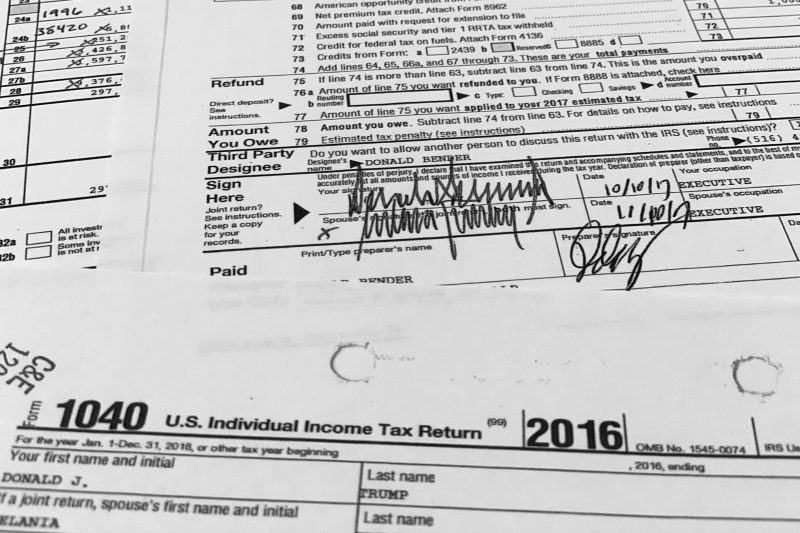

A Washington-based consultant for the Internal Revenue Service was charged Friday with stealing the tax returns of former president Donald Trump and thousands of wealthy Americans in 2019 and 2020 and providing them to two news organizations that reported how little the super-rich pay in federal income taxes, according to court filings and people familiar with the investigation.

Charles Edward Littlejohn, 38, faces one federal felony count of unauthorized disclosure of tax information, an offense punishable by up to five years in prison, the Justice Department announced Friday.

A three-page charging document did not identify Littlejohn’s company, the news organizations or the taxpayers involved beyond describing them as “Public Official A and thousands of the nation’s wealthiest people.” But charging papers allege that while working on an IRS contract, Littlejohn stole tax returns from about 2018 to 2020, then leaked the information of “Public Official A’s to News Organization 1” and the other tax information to a second organization between August 2019 and November 2020.

The dates align with the September 2020 publication of information from Trump’s tax records by the New York Times and the June 2021 report by ProPublica about the 400 top income-reporting Americans — a list led by Microsoft founder Bill Gates and Bloomberg information company founder Mike Bloomberg. It also included celebrities such as LeBron James, Taylor Swift and George Clooney. Two people familiar with the case who spoke on the condition of anonymity to discuss a pending criminal case confirmed Littlejohn’s charges were linked to those disclosures.

Littlejohn was charged by criminal information, a type of charging document typically used when a defendant has agreed to plead guilty and waived the right to indictment. Littlejohn and his defense attorney, Lisa Manning, declined to comment.

The charges mark the first public break in the Justice Department’s investigation of disclosures three years ago that Trump — a billionaire real estate developer who became the first modern U.S. president to refuse to release tax return information — paid $750 in federal income taxes in 2016. Revelations that he and other superwealthy Americans paid little or no federal income taxes over 15 years prompted criticism from many tax experts and fueled debate in Congress about the strategies employed, tax laws and agency enforcement.

While Democrats met the reports with calls to increase taxes on the wealthy and restore funding cuts to IRS tax enforcement, Republicans saw the leaks as politically motivated and timed for the height of the 2020 presidential election. The scope of the leaks also stunned lawmakers of both parties as well as IRS officials, where breaches of tax privacy have historically been rare.

U.S. Attorney General Merrick Garland called the leaks “astonishing” and “extremely serious” in June 2021, telling U.S. senators soon after taking office that their investigation would be a top priority.

The Biden administration has scaled back how aggressively it pursues journalists’ phone records or other data in such cases, but the Justice Department still investigates leaks of classified information or documents that are otherwise protected by federal law, such as sensitive financial data and taxpayer information, and prosecutes individuals when officials think the charges can be proven in court.

Court filings did not reveal how investigators traced the news reports to Littlejohn, alleging only that his unauthorized disclosures came in West Virginia. A Justice Department news release said the Treasury Inspector General for Tax Administration is investigating the case, and that it was being prosecuted by trial attorneys with the Justice Department’s public integrity section with assistance from the U.S. attorney’s office for the northern district of West Virginia.

The IRS said it cannot comment on pending legal issues.

But in a written statement, IRS Commissioner Danny Werfel said, “Any disclosure of taxpayer information is unacceptable,” adding, “The IRS has put in place new protocols and protections that tightened security, and our aggressive work in this critical area continues in order to protect the tax and financial information of taxpayers.”

A spokesman for Trump didn’t respond to a request for comment.

The New York Times declined to comment Friday. In a written statement, a spokesperson for ProPublica said, “We have no comment on today’s announcement from the DOJ. As we’ve said previously, ProPublica doesn’t know the identity of the source who provided this trove of information on the taxes paid by the wealthiest Americans.”

According to federal prosecutors, Littlejohn served from about 2017 to about 2021 as a contractor to a consulting firm with government and private clients, working primarily on tax administration contracts with the IRS.

A Washington Post Magazine dating column in June 2018 featured a participant named Charles “Chaz” Littlejohn, then 33, who described himself as a small-business owner and consultant originally from St. Louis “who lived on and off in the District over the past decade.”

Reached at the email address provided to The Post at the time, Littlejohn replied Friday, “As I trust you understand, I am not able to comment on the case.”

In an “Economics at Carolina” newsletter through the University of North Carolina, a Chaz Littlejohn said he worked for a consulting firm with the IRS and Treasury Department, after graduating from college and studying economics.

“I have had the opportunity to work on a workload transition project at the IRS, a strategy piece concerning Treasury’s financial regulatory overhaul, and an ID card issuance program at the Department of the Treasury,” his profile in the newsletter stated. “I quickly found myself in leadership roles relating to data analysis and forecasting and I’ve been able to apply the statistical techniques I learned as an Econ major to our work at the Treasury Department.”

He added that he would recommend his employer to anyone interested “in a private sector job that also has a strong social mission — namely, to improve the functions of government so that it may better serve the tax paying public.”