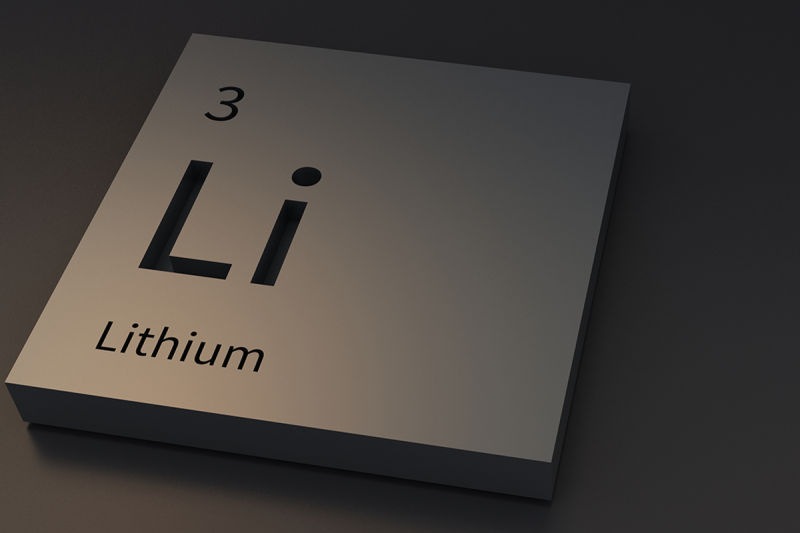

There’s no such thing as a guaranteed investment, but in the battery metals sector, lithium has had a very promising run thus far. Amid a global push for electrification and sustainable power, lithium demand has skyrocketed and it is expected to keep climbing in the long term.

Global demand for lithium batteries alone is set to increase at least fivefold by 2030, surpassing 2 million tonnes. Even with the rapid pace at which we’ve seen mining and exploration companies develop new projects in recent years, we’re still likely to fall short.

Fortunately for investors, as lithium gains increasing relevance and demand, investment opportunities in the lithium space will continue to gain traction. It should go without saying, however, that not all investment opportunities are created equal.

Nor are all lithium mineral sources.

Investors must develop an understanding of basic lithium mineralogy to understand how each lithium-bearing mineral impacts the way the critical metal is extracted and processed. Armed with this essential knowledge, they will be able to make more informed decisions and sounder investments.

The two main sources of lithium are hard-rock deposits and brine. This article will focus on a deep dive of the former, which is currently the larger source of lithium, making up 60 percent of mined supply, and it’s also the type of deposit found in Australia.

Different kinds of lithium ore

Found in countries throughout the world, lithium ore most commonly occurs in pegmatitic deposits of spodumene, lepidolite and petalite. Formed from crystallized magma beneath the earth’s crust, pegmatitic deposits often contain numerous other minerals as well, including niobium, tantalum and tin.

Limited quantities of lithium ore can also be found in sedimentary rock deposits, which collectively account for 8 percent of known global lithium resources. Lithium also occurs in the form of lithium brine, the most robust source of which is found in South America’s Lithium Triangle.

Spodumene

Spodumene is a pyroxene silicate mineral typically found in crystals that come in a wide range of sizes. It typically contains Li2O in theoretical concentrations ranging from 5.8 percent to 8.1 percent. Particularly pure, high-grade lithium spodumene may contain Li2O in concentrations from 7.1 percent to 10.1 percent.

Actual lithium content is usually within the range of 2.91 percent to 7.66 percent.

Interestingly, spodumene ore typically contains trace amounts of lepidolite, as noted by international downstream lithium processing expert Dr. Jingyuan Liu, non-executive director at Lithium Universe (ASX:LU7).

‘Both spodumene and lepidolite are lithium minerals in hard rock, occasionally coexisting in the same ore body,’ explains Liu. ‘Most spodumene ore contains a small amount of lepidolite and both are economically viable for lithium chemical extraction. The major differences between the two minerals are the crystal forms, lithium content and impurity profile.

‘Pure spodumene contains 8.03 percent Li2O, or lithia. However, pure spodumene is impossible to produce at commercial scale. Commercial spodumene concentrate typically ranges from 5 to 6 percent Li2O, which corresponds to roughly 75 percent spodumene in the concentrate.’

Lepidolite

Occurring in the form of mica, lepidolite exclusively forms in geochemical environments with a high concentration of lithium. A basic aluminosilicate of potassium and lithium, the common lithium-bearing mineral occasionally contains rubidium and cesium as by-products. Lepidolite is most often pink, red or purple in colour due to its manganese content.

‘Although more common than spodumene, lepidolite has a lower lithium content, ranging from 3.8 percent to 4 percent Li2O,’ Liu says. ‘Lepidolite concentrate contains numerous impurities such as potassium, fluorine and rubidium, all of which create processing difficulties. It costs more to produce lithium from lepidolite due to its different processing route, lower lithium content and higher impurity.

‘By contrast, spodumene concentrate contains fewer impurities. It’s relatively easier to produce high-quality lithium chemicals from spodumene in a conversion plant.’

While lepidolite does contain lithium, these downsides have led to spodumene concentrate being the preferred feedstock for lithium refineries as it reduces complexity and therefore decreases the initial capital development costs.

Petalite

Petalite is what’s known as a feldspar — a category of rock-forming silicates that comprise roughly 50 percent of the Earth’s crust. Typically occurring alongside spodumene and lepidolite, it’s noteworthy for containing a higher lithium-oxide to aluminum-oxide ratio than any other natural mineral. When exposed to sufficient heat and pressure, petalite converts to spodumene and quartz.

Fine spodumene vs. coarse spodumene

Once liberated from the ore body, spodumene may be processed in one of two ways, depending on the size of the grains. Generally speaking, larger and more coarse-grained spodumenes are more cost-effective to process. Liu says this largely comes down to the comparative ease with which lithium can be liberated from coarser grains.

‘There are two common spodumene beneficiation methods used in the production of spodumene concentrate,’ he explains. ‘Dense medium separation (DMS) and flotation.

‘DMS uses density differences to separate spodumene particles from gangue minerals. In heavy media, spodumene sinks while the gangues float. The process requires no chemicals, nor does it use a great deal of energy to mill the particles down — it therefore tends to be cheaper, easier to operate and more sustainable.’

The processing of finer spodumene particles requires flotation, according to Liu. Chemicals are used to modify the surface, allowing the spodumene to attach itself to rising bubbles while the gangues settle down into the solution. In addition to potential environmental harm, this process also requires huge amounts of energy.

A spodumene concentrator designed to handle coarse spodumene is less complex than a plant designed to process fine spodumene. It goes without saying the more complex the process is, the higher the initial capital expenditure is, and it will also contribute significantly to ongoing operational expenditures once the plant is commissioned.

Identifying prospective lithium greenfield targets

For the uninitiated, there are two broad categorizations of mining projects.

Brownfield projects are typically situated on or near a pre-existing mining site. With a brownfield project, historic exploration work provides a more concrete idea of prospects while also guiding exploration and discovery efforts. Typically regarded as low-risk investments, they are highly sought after.

Greenfield projects, by contrast, are completely unexplored, with little to no prior mining activity. Although considerably riskier than brownfield projects, a greenfield project has the potential to deliver an exponentially higher return. The challenge lies in knowing the difference between a sound investment and a waste of capital.

What are the core criteria for evaluation? Moreover, what do geologists look for when identifying lithium targets and defining a project’s economic resource?

Examining any available geological, mineralogical and geochemical data related to the exploration site is the first step. If no data is available, geologists will often opt to conduct their own tests, which may include soil samples, rock samples and magnetic surveys. Typically, they will then cross-reference their results with data from successful lithium projects.

It’s a simple idea, really — if a project displays similar geology to the site of a known lithium deposit, it follows that said project likely alsocontains a deposit.

A company might also look at its competition. Are other mining and exploration companies targeting the region for exploration, discovery and development? Have there been any recent and noteworthy successes in the vicinity?

More experienced executives and geologists also tend to have a good sense of whether or not a project has potential.

Take Iggy Tan, for instance. A trailblazer in the Australian lithium industry, Tan was one of the first mining executives in the country to recognize the opportunity the mineral represented. He then proceeded to seize upon that opportunity by founding Galaxy Resources (ASX:GXY), which soon established itself as one of Australia’s leading lithium mining companies.

Is coarse spodumene the future of lithium production?

Although lithium brine production has been receiving a great deal of media attention of late, spodumene production remains both economically feasible and commercially viable.

From a geology perspective, Canada currently has everyone’s attention — specifically the Eeyou Istchee James Bay region in Quebec. The discovery of coarse spodumene is becoming increasingly prevalent within the region, drawing the attention of multiple mining and exploration companies. There have been multiple exciting developments at lithium projects in the region this year alone.

Allkem (ASX:AKE,TSX:AKE,OTC Pink:OROCF) owns the James Bay project, and the company recently increased the mineral resource estimate for the project by a staggering 173 percent to 110.2 million tonnes at 1.3 percent lithium oxide between the indicated and inferred categories.

Not to be outdone, Patriot Battery Metals (ASX:PMT,TSXV:PMET,OTCQX:PMETF) announced in late July that it secured a C$109 million strategic investment from top global lithium producer Albemarle (NYSE:ALB). The company caught the attention of Albemarle after its release of a promising mineral resource estimate for the CV5 spodumene pegmatite at its Corvette lithium project in the Eeyou Istchee James Bay region. According to the estimate, CV5 contains an inferred resource of 109.2 million tonnes at 1.42 percent Li2O.

Coincidentally, Lithium Universe’s Apollo lithium project is situated in the same greenstone belt as Corvette, with a strikingly similar geological profile. With a dominant land position spanning over 240 square kilometers, the Apollo Lithium project has 17 pegmatite outcrops reported on the tenement package. The successes seen by its neighbouring projects mean it could be only a matter of time before Apollo demonstrates its true potential.

Investor takeaway

Lithium demand has exploded in recent years and will likely continue to do so for the foreseeable future. However, not all lithium-bearing minerals are built the same. Investors would do well to understand the basics of the battery metal — where it’s found, how it’s produced and how mining companies identify and select lithium resources. The more one learns, the easier it becomes to make sound investment decisions.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Lithium Universeand seek advice from a qualified investment advisor.